High Deductible Health Plans and How to Use Them

The purpose of this article is to provide a general overview of how a high deductible health plan (HDHP) works for a member and the group. The term “high deductible” means different things to different people, but usually it does one of two things: 1) it sends chills down your spine and makes you think it has “terrible coverage” or 2) you associate the term with “lower premiums”. Both scenarios could be accurate, but it all depends on how the group health plan is set up.

The HDHP concept makes sense to most employers. If you raise the group’s insurance deductible and/or out of pocket, the cost should go down per employee. It’s like going from a 3,000-square foot class-A office space to a 3,000-square foot open warehouse. Both put a roof over your head, but there is a difference when you walk in the door.

There are several options which can be used to combat the “high deductible” or “high maximum out of pocket” portion of the group’s medical plan. Unfortunately, there are instances where the employer is not told, or chooses not to hear this fact out of fear of complicating the group’s medical plan. One option, used by many brokers, is to educate the group on the use of gap insurance (like the Premium Saver), a Health Reimbursement Account (HRA), or a Health Savings Account (HSA) to cover the out of pocket costs.

First, let’s discuss how a high deductible health plan works.

HDHP | Qualified HDHP Defined

What is the difference between a HDHP and Qualified High Deductible Health Plan (QHDHP)? Many people refer to these plans differently, but for this discussion, we will define the HDHP/QHDHP as follows:

- A high deductible health plan (HDHP) is a health insurance plan with lower premiums and higher insurance deductibles than a traditional health plan. These plans have been around for many years and were designed to lower healthcare costs by allowing plan members the opportunity to analyze their healthcare decisions and share in a greater portion of the cost.

- A qualified high deductible health plan (QHDHP) is a plan that meets the requirements for plan members to utilize a health savings account along with their health plan.

- ➢ 2018 Deductible Requirement: $1,350 Individual/$2,700 Family

- ➢ 2018 Out of Pocket Maximum: $6,650 Individual/$13,300 Family

The main differences between these two plans are as follows: (1) a QHDHP has specific requirements. (2) You are unable to utilize other benefits in addition to the deductible (RX coverage, copays, etc.).

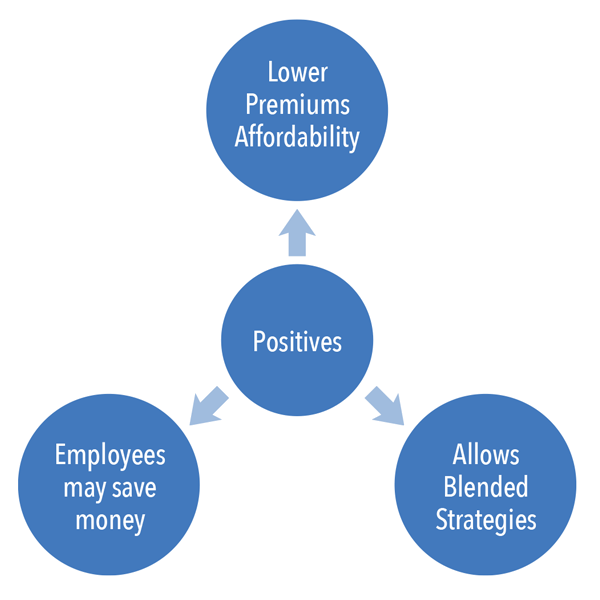

Pros of High Deductible Plans

-

Lower Premiums. Raising your deductible and/or out of pocket will lower your premiums. It’s like trading in your Mercedes SUV for a minivan. It may not have windshield wipers for your headlights, but it will get the kids to school on time.

Although affordability is a key factor for employers, raising health insurance deductibles is becoming much more common in today’s marketplace. According to the Kaiser Family Foundation, over 51% of employers have deductibles over $1,000. Each insurance company evaluates rates differently when it comes to high deductible plans, but after 30 years in the insurance business, our organization has surmised that a 30% discount would be a consistent average for increasing a group’s deductible from $1,000 to $5,000. On the other hand, we have seen reductions up to 50%.

-

Blended Strategies. Many employers prefer a high deductible/out of pocket plan because it allows the employer to customize alternatives for the group. Alternatives can include implementing an HSA, HRA or supplemental plan as options to provide benefits for the employee’s maximum out of pocket. Each of these options have different pros and cons.

If you have a $250 deductible/100% plan, it would be difficult to implement a blended strategy. In this example, everything is covered by major medical after the deductible, which means you are paying the insurance company a premium to handle everything. No HRA, HSA, gap plan, or customized alternative to reduce costs.

-

Employees Save Money. In the statistic below, the average employee pays approximately $5,000 in premium, per year, out of their own pocket for family coverage. If premiums were reduced by 30%, or $1,500 a year, and employees could have the option to contribute more, most employees would approve.

The Kaiser Family Foundation reports that for family coverage, the average policy totaled $17,545 a year with employers contributing, on average, 72% or $12,591. Employees paid the remaining 28% or $4,955 a year. Smaller employers, on average, pay only 65% of family coverage.

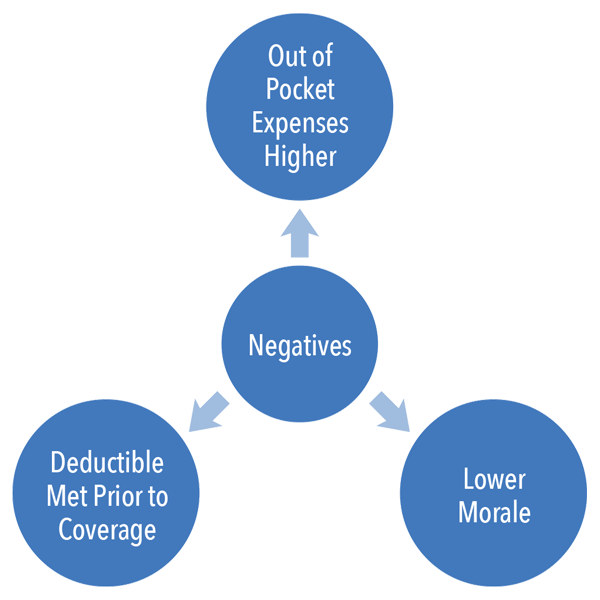

Negatives of High Deductible Plans

-

Higher Out of Pocket Costs. If an employer chooses to keep the savings and forgo secondary alternatives to the high deductible plan, the employee’s expenses will go up. Any survey will show that higher healthcare costs, experienced by the employees, is not well received and can hurt morale.

Employees who visit their doctor with a minor illness a few times a year will not really feel the effect of a high deductible plan. However, employees with chronic conditions will bear the expense burden when the HDHP is left standing alone. Higher employee costs, which lead to lower morale, affects the business in many ways.

- Deductible Met Prior to Coverage. On a Qualified High Deductible Health Plan (QHDHP), insurance claims go toward the deductible prior to being paid by the insurance company. Prescription costs and doctor office visits are the biggest headache with this plan design. Although coverage feels invisible until the deductible is met, employees can have a Healthcare Savings Account also known as an HSA which helps cover healthcare expenses.

To learn more, please complete the form on this page to request further information. You will receive a copy of our whitepaper entitled, “The Purpose of a High Deductible Health Plan” which discusses strategies and concepts you can use to lower your group’s health insurance.

Click below to receive our whitepaper

Request WhitepaperAbout the Author

Ryan Eaton is the Chief Marketing Officer and Executive Vice President of Morgan White Group. He has spent over 15 years with MWG in sales, management, or leadership roles. He currently manages a sales team that markets insurance products to over 22,000 agents in all 50 states. He is a husband and father of two boys and enjoys anything outdoors: sports, hunting, fishing, cooking out, and leading a father son Christian fellowship in his community.

-square.jpg)